CASE STUDY

SCION-powered SSFN: STRENGTHENING THE SWISS FINANCE SECTOR

The Secure Swiss Finance Network (SSFN), launched by the Swiss National Bank and SIX, leverages SCION technology to enhance security, resilience, and efficiency in financial communications. This blog explores the challenges faced by the legacy network, the benefits of adopting SCION, and the successful implementation of SSFN, which has revolutionized communication in the Swiss financial sector.

Share this post

SSFN @ A GLANCE

SCION adopters: SIX and SNB

Project start: 2020

Go-live: June 2022 with SIC and euroSIC on the SSFN

Geography: Switzerland

Joiners: around 300 financial institutions

SCION providers: Anapaya, Cyberlink, InfoGuard, InterCloud, Swisscom, Switch, Sunrise, VTX, libC

Certificate provider: SIX

KPIs | Outages: 0 | Security issues: 0 | Data breaches: 0

For more info abut the SSFN go here.

BACKGROUND

The Secure Swiss Finance Network (SSFN) is a collaborative initiative launched by the Swiss National Bank (SNB) and SIX, Switzerland’s key financial market infrastructure provider.

As part of its mandate to cultivate trust in money, the SNB is responsible for the Swiss Interbank Clearing (SIC) system, which uses central bank money to process interbank and retail payments in a final and irrevocable manner. Given its systemically important role in the financial system, the SIC must operate within a secure, safe, and resilient data communication network.

For SIX to fulfill the SNB’s mandate adequately, it must ensure a continuous flow of information and money between financial market participants while maintaining secure and efficient digital operations. Therefore, it was imperative that the financial communication infrastructure it used, FinanceIPNet, adhered to stringent criteria. These included:

- Certainty regarding the identity of all participants,

- Guaranteed integrity in the transmission of messages, and

- A robust and resilient communication infrastructure.

Faced with increasing cyber risks and an aging FinanceIPNet, the SNB and SIX explored new solutions. After careful evaluation, they selected SCION as the network technology to provide secure, flexible, and resilient data communication among financial institutions in Switzerland and power the SSFN.

The SSFN is a monitored and protected network that allows authorized participants in the Swiss financial center to communicate securely with each other and with financial market infrastructures over SCION. It provides a reliable, multi-operator connectivity layer for critical applications, such as the SIC interbank payment system, which clears more than 150 billion CHF and 2.6 million transactions every day on average.

Legacy network challenges

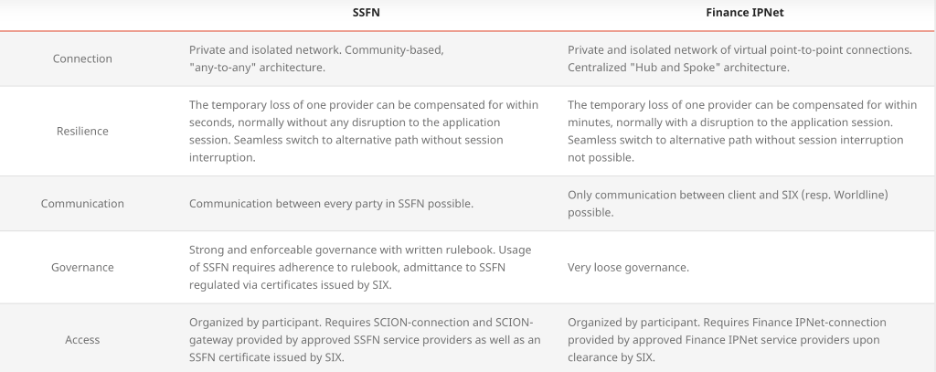

With the shift away from private networks toward more flexible, Internet-based solutions, the 20-year-old FinanceIPNet network faced limitations despite its two-decade history of security and capacity. These limitations included inflexibility, high costs, and vulnerability to cyber risks. Additionally, this network serves critical real-time systems like SIC, requiring the strongest possible protection and availability.

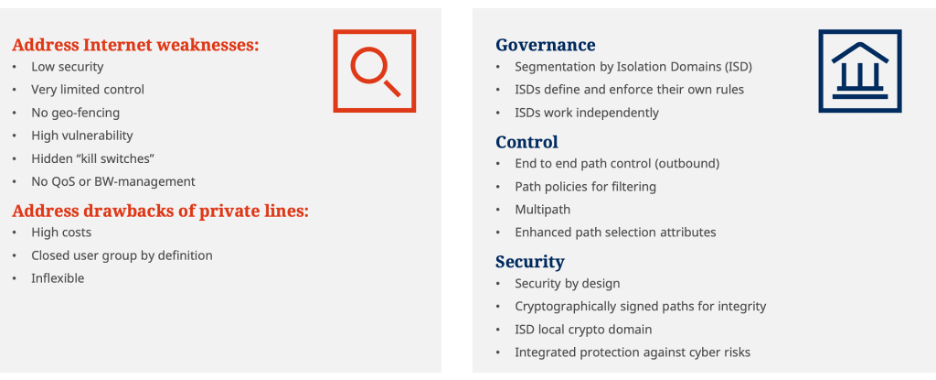

As the industry moves away from private networks toward cloud-based and flexible networks, new challenges have arisen:

- The legacy network, based on leased and MPLS lines, was inflexible and costly, offering limited point-to-point connectivity instead of the required any-to-any communication among connected organizations.

- Solutions on top of the public Internet couldn’t guarantee the needed resiliency and availability due to hidden “kill switches,” long reaction times in case of failures, and uncontrollable network paths.

- The network needed to be multi-provider and serve multiple customers, avoiding single points of failure.

- Critical payment data needed protection in transit to ensure sensitive financial data remained within a trusted area and to avoid network-based attacks. With FinanceIPNet, data was transmitted with various security measures, including mandatory encryption and authentication on the payment message layer.

- Network governance needed to be enforceable with clear boundaries.

Why SCION

Depending on a single provider or even a dual provider setup created a classic provider lock-in situation, while using the Internet introduced unreliability and insecurity. So, what to do?

A thorough analysis and comparison of different technologies were conducted, including the consideration of modernizing the existing MPLS. SD-WAN was briefly discussed but deemed unsuitable for a multi-provider, multi-product, multi-customer market. SCION met the necessary requirements and was chosen due to its flexibility and adaptability to multi-party networks, making it suitable for the SSFN initiative.

SCION offers the best of both worlds: the security of private lines and the flexibility of the Internet.

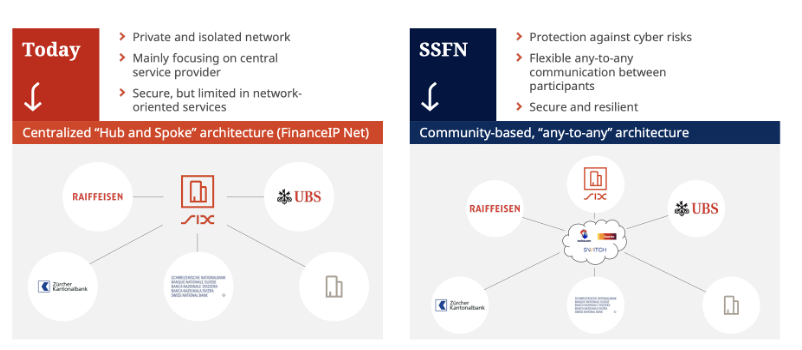

With SSFN, the network moved away from the traditional hub-and-spoke architecture, leveraging SCION’s built-in cryptography to enforce governance and set strict boundaries. SSFN also uses SCION’s concept of Isolation Domain to maintain strict governance over entities in the network. This approach extends trust, identifies network parties, and enables any-to-any communication without disrupting existing business models.

Benefits of the SSFN

Protected data exchange for enhanced security

SSFN allows a precisely defined group of users to exchange data in a controlled manner, separate from the public Internet. The visibility of network paths ensures that data is protected while in transit, increasing security and safeguarding data from theft, manipulation, and spying.

Resilient data traffic for network reliability

Collaboration with multiple ISPs (Internet Service Providers) that offer SCION ensures redundant connections among all connected parties. The temporary loss of even an entire provider can be compensated within seconds, usually without any disruption to the application session, thanks to the ability to use multiple network paths simultaneously.

Controlled access for higher trust and reduced attack surface

Network access to the SCION Isolation Domain (ISD) is only possible by obtaining the corresponding SCION certificates based on well-established governance rules. This significantly reduces the attack surface and helps prevent cyber-attacks.

KEY GOVERNANCE ENABLED BY SCION

The SSFN is governed by four key principles:

- SCION allows for local, user-centric, enforceable governance.

- Governance can be separated from actual operations; the governance parties don’t need to be the same as those who operate the network.

- The Isolation Domain concept allows for complete isolation of trust without dependencies on external PKIs.

- Multiple operational models can be implemented, supporting various business models.

Governance Structure

The SSFN ISD focuses on a user-centric, enforceable, and shared governance model. Authentication in the network does not rely on external parties and is fully governed by a set of voting members, including the Swiss National Bank, SIX, and SWITCH, who collaboratively define rules. Thanks to SCION’s cryptographic features, no single entity retains full control over the network, enhancing trust.

A LOOK AT THE SSFN TODAY

The SNB has been actively processing interbank payments on SIC via SSFN since mid-2022, demonstrating the practical implementation of SCION technology in a productive environment. The multi-provider approach has not only enhanced operational capacity but also facilitated a resilient work environment, especially during challenging times such as the recent pandemic.

Following the decommissioning of FinanceIPNet in 2024 as the gateway to its infrastructure services, the SSFN has proven successful as a communication service.

For financial institutions, the transition to the SSFN typically required 3 to 6 months. Additionally, the annual operating costs associated with accessing SSFN are estimated to be in the mid-five-digit range.

The range of services available via SSFN has expanded from interbank clearing to other SIX services. SIX ensures that all services currently accessible through FinanceIPNet are also accessible through SSFN.

Banks and other financial institutions participating in the SSFN can leverage SCION technology for further use cases, such as ensuring the availability of connections for remote workforces or specific websites (e.g., eBanking).

CONCLUSION

Since its inception, SSFN has proven to be a robust and reliable network. Operating without glitches, it continues to support the evolving needs of the Swiss financial industry. Looking ahead, SSFN will keep adapting to emerging trends and potentially expanding its benefits beyond the banking services sector.

By leveraging SCION technology and implementing a robust governance structure, SSFN stands as a secure, flexible, and resilient communication platform for the financial industry. The integration with SCION ensures secure, resilient communication networks, addressing challenges and providing a foundation for future growth.